Our investment strategies

Invest your pension assets from as little as CHF 20 in our relevate strategies.

Invest with strategy!

Invest pillar 3a and vested benefits in index funds

At relevate, you can invest your retirement savings in various index fund-based strategies, instead of leaving them in your account. In this way, you can increase your return opportunities and maximise your retirement potential.

- What are index funds?

- The benefits of index funds

- The index funds at relevate

- The advantages of equity funds

- Equities or savings – which is better?

- Equities: more than inflation protection

- Conclusion: pillar 3a and vested benefits investing pays off

What are index funds

Just like ETFs (exchange-traded funds), index funds track securities indices, allowing them to be used to invest in a broad range of asset classes such as equities, bonds or commodities. The only significant difference to ETFs is that index funds are not traded on the stock exchange. Instead, fund units are bought and sold directly via the fund provider or financial service providers such as relevate.

The benefits of index funds

As index funds are not actively managed by a fund manager but try to replicate the composition of an index – they also referred to as “passive funds” – investors incur very low fees.

Securities indices such as the Swiss Market Index (SMI) or the US S&P 500 contain several tens to hundreds of stocks. Global indices such as the MSCI World or the FTSE All-World are made up of thousands of equities. Investors buying index fund units do not need to worry about broad diversification.

There are not only passive equity funds, but also funds that track indices of other asset classes. This allows private investors to invest their capital easily and securely in complex asset classes that are otherwise reserved for financial professionals.

The index funds at relevate

At relevate, you can invest your pillar 3a and vested benefits assets in Swisscanto funds from Zürcher Kantonalbank (ZKB). You can choose from the following asset classes, which can be weighted differently with our strategies:

Equities

Bonds

Real estate

Precious metal (gold)

This is why equity funds are so attractive for pillar 3a

Equities are the asset class with the highest historic returns. Assets such as bonds, real estate and precious metals perform comparatively worse. Investors pay for this return with a higher risk. Particularly in the short and medium term, equities and equity indices sometimes fluctuate sharply, and even drastic price losses are not unrealistic.

But this risk can be greatly reduced by a long holding period – at least this has been the case for the past 50 or so years. Investors who were globally diversified and invested long-term in equities during this period, for example with an MSCI World index fund, always achieved a positive return with a holding period of around 15 years or longer. It is not possible to conclude with certainty that these historical experience will be repeated in future.

However, it is highly probable that the “buy and hold” approach will continue to bear fruit, given the fact that our economic system is based on long-term growth. Without this growth, which is reflected, among other things, in rising share indices, it just doesn't not work. So as long as we live in an economic system that needs and generates growth, global share prices can be expected to rise in the long term.

This is good news for all investors looking to invest long-term 3a or vested benefits assets, because they know that if there are still at least 15 years to go before the planned payout, investing in equities is very promising.

Equities or saving?

Should pillar 3a and vested benefits be put in a savings account or securities custody account? – Many pension providers in Switzerland are asking themselves this question. In answering, one issue must not be overlooked: inflation.

Inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time. The consequence of inflation is continuous devaluation of the currency.

A sensible investment should at least compensate for this devaluation, so that for every franc you put aside today, you can continue to buy what you are currently getting in return. Of course, it is even better if the money actually increases in real terms by means of interest and compound interest.

Savings accounts that only offer a fixed interest rate have been able to compensate for inflation on average over the past two decades – but that’s all. For example, the real interest rate (nominal interest rate minus the rate of inflation) averaged 0.05% per annum between 2000 and 2019, according to SWI. Of these 20 years, only 11 had a positive real interest rate, while in nine it was negative. 1,000 francs deposited in a savings account in 2000 would have become only around CHF 1,010 20 years later, equivalent to an increase of 1%.

Let’s compare this with an investment in an index fund that tracks the SMI, for example. The Swiss blue chip index increased 16% between 2000 and 2019. CHF 1,000 would have become CHF 1,160 – despite the fact that the SMI had to overcome the bursting of the dot-com bubble and a global economic crisis.

Equities: more than inflation protection

As we have seen, we can expect more from equities than just compensating for inflation. But why do they beat the savings account so clearly by historical standards? Because share owners can benefit from inflation. There are two reasons for this:

1) Equities are tangible assets

Equities represent a share in a company and so are tangible assets, because shareholders are the co-owners of a company’s tangible and intangible assets. These include land, buildings, machinery, patents and trademarks. With general inflation, these assets will also increase – putting aside of course loss in value due to age and use.

2) Inflation can be passed on

Many companies can pass on inflation directly to their customers or end-consumers through price increases. This means that even though the purchase prices for energy and raw materials increase, sales increase too. Only when wages have to rise as a result of the economic loss of purchasing power do companies feel the effects of inflation. In the meantime, they may even profit from inflation by raising prices above the rate of inflation in order to improve margins. This in turn benefits shareholders through share price rises and/or higher dividends.

What applies to equities also applies to other tangible assets such as precious metals and real estate. They, too, are independent of monetary value and thus protect against inflation.

Conclusion: investing in pillar 3a and vested benefits pays off

As shown, investing 3a and vested benefit balances in index funds may be worthwhile for you. Instead of simply keeping the value of your money in a savings account, you have the opportunity to invest in a broadly diversified manner in various asset classes that have historically generated significantly higher returns. This may result in significantly higher pension assets by the time they are disbursed.

FAQ Strategies

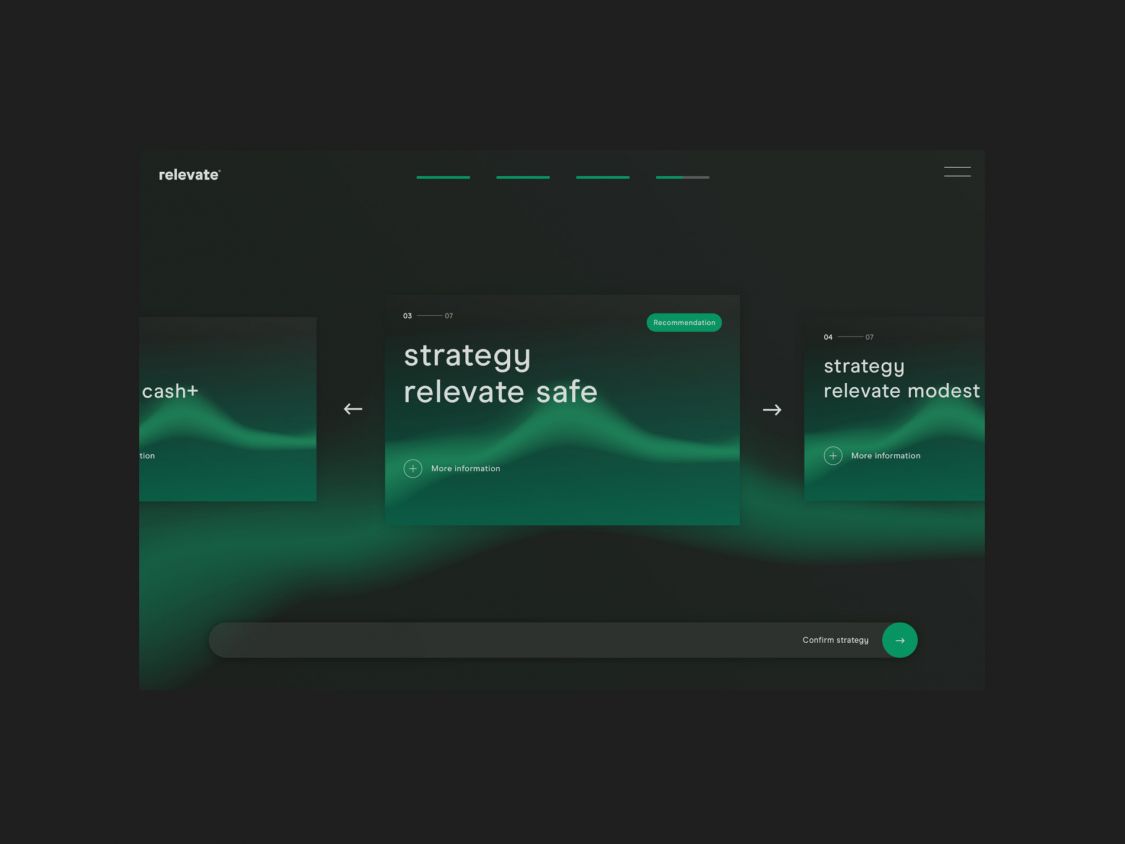

What investment strategies does relevate offer?

relevate offers eight different investment strategies with different levels of risk:

- cash

- cash+

- safe

- modest

- dynamic

- ambitious

- maximum

- excited

Risk is primarily determined on the basis of a strategy’s equity weighting.

Which investment instruments are used?

relevate uses the following investment instruments:

- Cash Deposits

- Long- and mid-term bonds

- Short-term bonds ("money market")

- Stocks

- Real estate

- Precious metals and gold (listed as “alternative investments”)

Not every strategy uses all instruments.

How do I choose an investment strategy?

When you are onboarded at relevate or open a new portfolio, you will receive an investment strategy recommendation from us that is tailored to your risk profile. But you are not obliged to choose the recommended strategy and can also opt for a lower risk or higher risk strategy if you prefer.

Which strategy suits me best?

During the onboarding process, we recommend a strategy based on your risk profile and investment horizon, which we determine on the basis of several questions. However, you are free to choose your ultimate strategy and change it at any time. When choosing your strategy, you should consider aspects such as:

- Your risk tolerance

- Your return expectations

- Your investment horizon

How can I adjust my strategy?

You can change your strategy at any time in the client portal. It is implemented on the second bank working day of the week.

Can I invest in different strategies?

You cannot invest in different investment strategies within the same portfolio. But you can choose a different investment strategy for each portfolio.

Can I only invest part of my pension capital?

Yes, only a portion of your pension capital can be invested in your chosen investment strategy. In this case, the rest remains in the account as a cash deposit (relevate cash strategy).

Where are the securities held in custody?

relevate’s custodian is Zürcher Kantonalbank (ZKB).

When do I need to order a change of strategy for it to be executed the same week?

A change in strategy must be submitted no later than the end of the first bank working day of the week.

What is the minimum investment amount?

Pension assets at relevate can be invested in the selected strategy from an amount of CHF 20.

At what price are the investments traded?

Orders must be submitted by the end of the first bank working day of the week. Investments are traded at the closing prices of their underlyings on the second and third bank working days of the week – depending on whether the fund consists solely of underlyings domiciled in Switzerland or not.

Can I decide for myself when to buy or sell investments?

What is possible is to initially leave your pension assets in the account as a cash deposit using the relevate cash strategy and only invest with a different strategy at a later date.

Conversely, you can also switch from fund-based strategies back to cash, initiating a prompt sale of your investments on the next trading date.

How long do purchases and sales take?

Purchases and sales of securities are always carried out on the second bank working day of the week. The posting will be displayed in relevate three to four bank working days later.

Is it possible to cancel a purchase or sale?

relevate buys or sells securities on the basis of the investment strategy you have chosen. The pension assets are always invested either in full or in the chosen strategy on the trading date on the second banking day of the week (depending on the investment procedure chosen). A change in investment strategy is always executed on the next trading date. This means that you can cancel purchases and sales up to the end of the first banking day of the week by selecting the original strategy again.

Am I entitled to attend Annual General Meetings?

No. Swisscanto Fondsleitung AG or its representatives are responsible for proxy voting.

What does rebalancing mean?

All investment strategies have neutral weightings for the constituent investments. Market movements can lead to a shift in these weightings. Rebalancing means returning the current weighting to the neutral position.

Example: In the relevate maximum strategy, the neutral equity weighting is 85%. As a result of the positive market situation, the equity indices tracked by the funds included rise more strongly than the indices for bonds, real estate and precious metals also replicated by funds included. As a result, the current equity weighting rises to over 85%. Rebalancing must be carried out in order to restore the desired distribution of asset classes and thus the original risk profile of the strategy. This is done by selling equity fund units and/or buying units in the other funds.

When is the portfolio rebalanced?

Rebalancing takes place quarterly.