Pillar 3a account

Invest your 3a assets in high-quality Swisscanto funds now.

- Good return opportunities

- Choice of eight strategies

- Low all-in fee

- Fully digital solution

- Simple registration process

Pension calculator pillar 3a

The relevate pension calculator gives you an indication of the potential development of your pension funds and an overview of historical performance based on real data.

Your details

Age

years

professional situation Info

Payment per year

CHF

3a start capital on relevate

CHF

Investment type

Conservative

Cautious

Thoughtful

Balanced

Opportunity-oriented

Adventurous

Daring

Risk-seeking

relevate strategy recommendation for you

Year

Number of Years

Performance index of recent years

relevate®

Preview of your assets with relevate

excellent

average

poor

Open an account free of charge now!

-

Select product

-

Define strategy

-

Take out contract via digital onboarding

Pillar 3a FAQs

General information

What is pillar 3a?

Pillar 3a is the third element of Switzerland’s three-pillar retirement provision system, alongside state old-age and survivors’ insurance (OASI) and occupational pension provision through pension funds. Taken as a whole, the third pillar also includes pillar 3b.

The two pillars, 3a and 3b, together form the private part of retirement provision. They differ in that pillar 3a is restricted and subsidised by the state, whereas pillar 3b is unrestricted and is not subsidised. This means that as a rule, capital from pillar 3a can only be withdrawn after retirement, while capital from pillar 3b can be freely disposed of at any time.

The purpose of the third pillar is to raise the standard of living of pensioners to the level they enjoyed during their working lives. Pillar 3a is subsidised through tax privileges both during the saving phase and when the capital is paid out. The maximum amount subsidised per year is limited by law.

What is a pillar 3a account?

A pillar 3a account (or third pillar account) is a special type of account that serves only to collect a person’s savings for pillar 3a. Pillar 3a accounts are offered by banks, foundations and insurance companies.

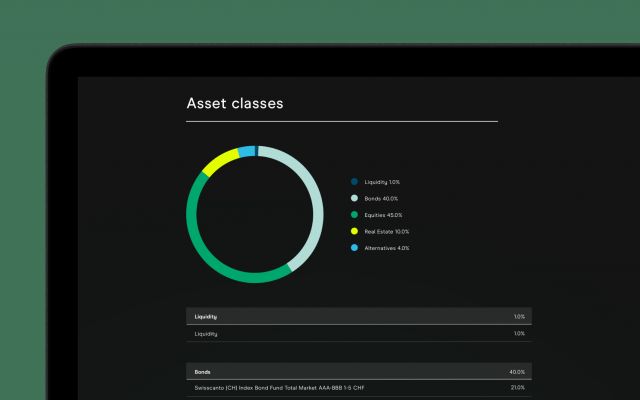

Not all pillar 3a accounts are accounts in the traditional sense that offer a specific rate of interest on the money invested which varies over time. There are also pillar 3a accounts that are similar to a securities custody account and are therefore sometimes referred to as “pillar 3a custody accounts”. Pillar 3a assets are not booked in these accounts as cash at a specific interest rate. Instead, the funds are used to buy units in equity, bond, precious metal or real estate funds whose value may rise or fall over time.

relevate is both a 3a account and a custody account. With us, you can save your third pillar assets as a cash deposit at a fixed interest rate (relevate cash strategy) or invest them (additionally) in different funds (the other seven strategies).

What are the benefits of a pillar 3a account?

Those who pay the maximum amount into their pillar 3a account each year can enjoy significant tax benefits that ensure a direct return on the savings amount. In addition, there are tax breaks when withdrawing capital at a later date, which means that a private pillar 3a pension scheme can be more lucrative than a purely privately run pension scheme with standard financial products.

Saving in pillar 3a also has psychological benefits. The publicly communicated maximum amount creates an official reference value for the best-case minimum private pension provision per year. Without this figure, it is entirely up to savers themselves to decide how much to put aside.

Furthermore, tying pillar 3a assets to the purpose of retirement provision ensures that pensioners are not tempted to use the money for other purposes and thus jeopardise their standard of living after retirement.

Does depositor protection apply to my 3a assets at relevate?

No, there is no depositor protection for cash deposits in pillar 3a accounts (relevate cash strategy). However, pillar 3a assets up to a maximum of CHF 100,000 per client and pension foundation are treated preferentially under bankruptcy law.

No deposit guarantee or preferential treatment is required for 3a assets invested in funds using one of the other relevate strategies, as these assets are classed as special assets. If a bank goes bankrupt, these funds are transferred to the pension foundation.

You can find more information on this topic on the website of the esisuisse association.

Account opening & deposits

How do I open a pillar 3a account with relevate?

Anyone who has reached the age of 18 and is under the age of 64 (women) or 65 (men) can register with relevate.

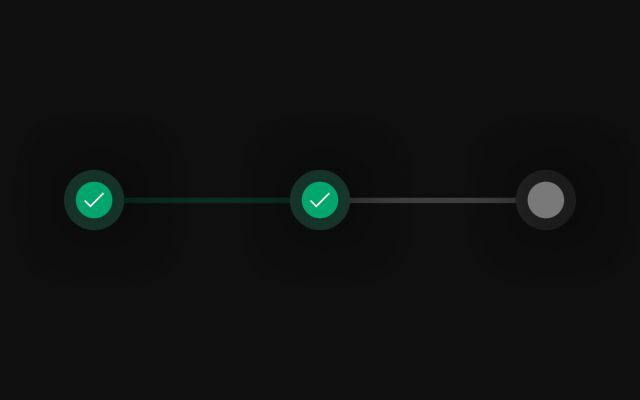

As a new client, you can open a pillar 3a account in just a few steps:

- Register and select product

- Define your risk profile and strategy

- Make a deposit or transfer

How many pillar 3a accounts am I allowed to have by law?

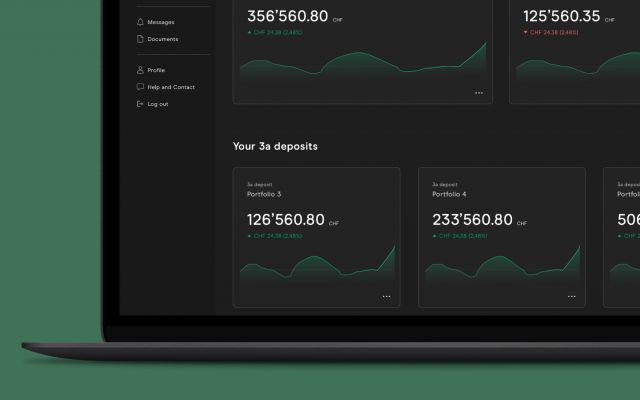

There is no legal limit to the number of 3a accounts. At relevate, you can open up to five different portfolios.

Can I open multiple 3a portfolios at relevate?

You can open a maximum of five portfolios per policyholder at relevate.

Above what amount should I open a new 3a account?

This depends on a number of factors. It is often worthwhile to open another account above an amount of around CHF 50,000.

How do I open another 3a portfolio at relevate?

If you want to open a 3a portfolio as an existing client, you can do this quickly and easily via the “Add product” option.

If you already have the same product, you will be able to apply your existing risk profile and investment strategy to the new portfolio.

How can I transfer money from another pillar 3a account to relevate?

Once the account has been opened, we will send you all documents to transfer your 3a funds.

What requirements need to be met in order to make a payment into the third pillar?

To join the third pillar, you need to be earning employment income in Switzerland on which you pay old-age and survivors’ insurance (OASI) contributions. There is no minimum amount for opening a 3a account with relevate, but 3a funds can only be invested with us from CHF 20. Up to this limit, they will remain in the account as a cash deposit.

You can find more information on this topic here:

How can I deposit money in my pillar 3a account at relevate?

The “Paying into your portfolio” page will tell you how much you can pay in this year. The “Pay now” button will take you to the payment instructions with the QR code which you can scan in quickly and easily in your e-banking.

What is the maximum amount I can pay into pillar 3a?

As a rule, the maximum amount changes every one to three years. Currently (2026) it is CHF 7,258 for employees and CHF 36,288 or a maximum of 20% of net income for self-employed people who are not members of a pension fund.

You can find more information on this topic here:

Do I have to pay a fixed amount into pillar 3a?

No, you can determine the amount yourself, as long as it does not exceed the maximum limit. Please also note that pension assets can only be invested with us from an amount of CHF 20. Until this amount is reached, the funds will remain in your retirement account as a cash deposit (relevate cash strategy).

Are fees charged on a deposit or transfer?

No, we do not charge fees on deposits or transfers.

Can I only invest part of my pillar 3a capital?

Yes, only a portion of your pillar 3a capital can be invested in your chosen investment strategy. In this case, the rest remains in the account as a cash deposit (relevate cash strategy).

Can I decide for myself when my pillar 3a assets are to be invested after I have deposited them in my account?

Yes, the funds can initially remain in the relevate account as a cash deposit (relevate cash strategy). They can then be invested at a time to be determined by the account holder themselves. Trading itself always takes place on a weekly basis on the second bank working day.

When is the pillar 3a capital invested?

Investments at relevate are always carried out on the second bank working day of a week.

I have paid in more than the maximum amount – how and when will I be reimbursed the difference?

If you have paid in more than the maximum amount, the portion in excess of the maximum will be rejected by the tax authorities. You will receive a notification from the tax authorities which you can send to us to arrange for the reimbursement. After receiving it we will reimburse you the excess amount.

Is there a minimum term for pillar 3a retirement provision with relevate?

No, there is no minimum term for pillar 3a retirement provision at relevate.

Can I make retroactive payments into my pillar 3a account?

At present (as of 2023), it is not possible to pay money into pillar 3a for previous years. However, a change in the law has already been decided. This will be implemented within the next few years and it will then be possible to make retrospective payments into the third pillar.

More information on making retrospective payments into pillar 3a is available here:

Can partners with a joint tax return both open a pillar 3a account?

Yes, provided both partners have employment income eligible for OASI contributions, they can both open a pillar 3a account.

Account closure & payouts

When can I withdraw the money from my third pillar account?

The money in pillar 3a can be paid out at the earliest five years before the regular retirement age of 65 for men or 64 for women respectively. If you continue to work beyond this age, you may defer withdrawing your pillar 3a assets for up to five years.

Earlier withdrawal is also possible in certain cases. You can find out more here:

How can I have my pillar 3a account paid out?

At relevate, the account closing procedure is as follows:

- Select the “Edit” button in the portfolio overview.

- Now select the option “Close portfolio”.

- Enter the reason for the closure.

- We will send you a document template.

- Fill it in and sign it.

- Send us the template by post.

- We will then process your request and pay you your vested benefits.

Can I also withdraw only part of my third pillar assets?

Yes, you can withdraw part of your third pillar assets early and leave the rest in the pillar 3a account. However, this is only possible for a certain period of time. If there are fewer than five years between the date of the early withdrawal and regular retirement age, the entire amount of an individual pillar 3a account must be withdrawn. However, not all accounts have to be closed at the same time.

This means that if you have several pillar 3a accounts, you can close them in stages even if you will reach retirement age in fewer than five years. In terms of the total capital from pillar 3a, this corresponds to a partial withdrawal, even though the withdrawal amounts are not freely selectable. The withdrawal amounts in this case are the account balances of the individual accounts.

More information on staggered withdrawal from pillar 3a is available here:

What is an early withdrawal for home ownership purposes (WEF) from pillar 3a?

This is an early withdrawal made in the context of the promotion of home ownership (WEF). You can withdraw pillar 3a retirement assets in full or in part in order to finance residential property that you will occupy yourself. It is also possible to pledge the pillar 3a retirement assets for this purpose.

How often can I make an early withdrawal from pillar 3a for home ownership purposes?

An early withdrawal to buy residential property is permitted every five years.

Do I have to withdraw my third pillar assets if I move abroad?

No, the 3a assets only become payable at the age of 64 (women) or 65 (men). If you continue to work, the payment can be postponed until you stop working, for up to a maximum of five years.

More information on pillar 3a and emigration can be found here:

What happens to the pillar 3a account if I die?

In the event of the policyholder’s death, the vested benefits accrue to the statutory beneficiaries. The Ordinance on Occupational Old Age, Survivors’ and Invalidity Pension Provision (OPO 2) and the Federal Act on Vested Benefits in Occupational Old Age, Survivors’ and Invalidity Pension Provision (OPA) determine who those beneficiaries are. By defining an individual order of beneficiaries, the account holder can also influence the sequence of beneficiaries themselves.

You can find more information on this topic here:

What happens to third pillar assets in the event of divorce?

In the event of divorce, the funds from pillar 3a are handled differently to those from the pension fund, as the matrimonial property regime applies here. This stipulates that the pillar 3a assets are divided equally between the parties.

However, third pillar capital accrued before the marriage is excluded from this rule. If a prenuptial agreement is in place, this takes precedence over the matrimonial property regime and the arrangements vary from case to case. It is therefore advisable to seek legal advice in the event of an imminent separation or divorce.

More information on pillar 3a and divorce can be found here:

Can I transfer my 3a securities to my private assets when they are paid out?

The 3a securities in the relevate investment strategies are specially designed for pensions and therefore cannot be transferred to your private assets.

Can I maintain my 3a account after reaching OASI retirement age?

Yes, you can maintain your 3a portfolio after you reach the OASI retirement age. But to do so you must show that you are still in employment. You may only continue to hold the portfolio until the age of 69 (women) or 70 (men). Thereafter the portfolios have to be liquidated and withdrawn.

How is the third pillar taxed?

Pension assets in a pillar 3a account are not subject to income or wealth tax. If the funds are paid out, they are taxed at a reduced rate.

You can find out more about pillar 3a and tax on the following pages:

Subsequent contributions to Pillar 3a

When can I start paying into pillar 3a retrospectively?

Anyone who hasn’t paid in the maximum amount or didn’t pay in previous years will be able to make a subsequent contribution from 1 January 2026. The only gaps eligible are those from 2025 onwards. Unfortunately, any contributions missed prior to 2025 cannot be paid into pillar 3a retrospectively.

How do I make a subsequent pillar 3a contribution at relevate?

To build up your pillar 3a with relevate at a later date, simply apply for this digitally via your dashboard. Once approved, you can pay in the desired amount immediately and fill in any gaps in your pillar 3a.

How much can you pay into pillar 3a retrospectively per year?

The maximum retroactive contribution to pillar 3a cannot exceed the currently applicable maximum amount for employed persons affiliated with a pension fund (CHF 7,258 as of 2026). This maximum also applies to self-employed people, although they are allowed to pay more into pillar 3a (max. CHF 36,288 p.a. as of 2026).

Thus, anyone who did not make a contribution in 2025 even though they would have been entitled to do so can theoretically pay in CHF 7,258 twice in 2026.

Can you pay into pillar 3a retrospectively at relevate?

Yes. At relevate, you can make both regular contributions and pillar 3a purchases. Please do not hesitate to contact us if you have any questions about how to make retrospective contributions to pillar 3a. We would be happy to help.

How many years back can I retrospectively pay into pillar 3a?

In principle, missed contributions can be made up for up to 10 years. Only gaps from 2025 onwards are eligible, and these can be paid in retrospectively from 2026.

Missed contributions dating back more than 10 years ago will expire and will no longer be able to be paid in retrospectively.

Is it always possible to buy into pillar 3a?

No. The regular pillar 3a maximum amount (CHF 7,258 as of 2026) must be paid in in the purchase year before you can pay additional contributions into pillar 3a retroactively.

Do I have to apply for the contribution from the pillar 3a foundation first?

Yes. In order for us to enable a pillar 3a purchase, this must be reviewed and approved in advance.

At relevate, this process is completely digitalised. We use a self-declaration system to confirm directly whether you can pay into pillar 3a retrospectively.

What are the requirements for topping up gaps in your pillar 3a?

Subsequent purchases into pillar 3a can be made if all of the following conditions are met:

- The subsequent contribution is limited to the maximum annual amount (CHF 7,258 as of 2025) – regardless of the value of the unpaid contributions.

- Income subject to federal retirement and survivors’ insurance, AHV/AVS, existed both in the purchase year and in the year in which the contribution was missed.

- Any subsequent contribution must be requested and approved in advance by the pillar 3a foundation. Subsequent 3a contributions cannot be made without the consent of the foundation.

Can I split any unpaid contribution from a previous year over several years?

No. A specific gap (e.g. from 2025) cannot be split over different years; the retrospective contribution can only be made once.

If, for example, there is a gap of CHF 5,000 from 2025 and only CHF 2,000 is paid in retrospectively in 2026, the remaining CHF 3,000 will be forfeit.

Can several gaps from previous years be added together and lumped into the same retrospective contribution in one year?

Yes. Several gaps from previous years (e.g. CHF 1,000 from 2025 and CHF 2,000 from 2026) may be added together in order to pay a total of CHF 3,000 in 2027. However, the annual upper limit for buying into pillar 3a (maximum CHF 7,258 in addition to the ordinary contribution) will remain in place.

Can both partners make subsequent payments into pillar 3a if they are married?

Yes. If both persons have gaps from previous years, then both partners can make subsequent contributions to their pillar 3a and thus optimise their own individual provision.

Are subsequent contributions to pillar 3a posted to the same account as regular contributions?

Yes. Unless stated otherwise, the money from a subsequent contribution is posted to the same account and then invested in the selected investment strategy.

However, a new, additional pillar 3a account can also be opened to enable subsequent buy-ins into pillar 3a and benefit from staggered withdrawal. relevate recommends this from retirement account assets of approx. CHF 50,000 or more.

Does the subsequent contribution have to be made to the same pillar 3a foundation as the regular contribution?

No. Theoretically, the ordinary contribution and a subsequent contribution can be made to different foundations. However, the foundation that accepts the money to fill gaps in your pillar 3a must first check whether the statutory requirements for the contribution have been met.

When does the option of retrospectively paying into pillar 3a expire?

As soon as a pillar 3a account has been closed and the assets withdrawn due to retirement (possible from the age of 60), no subsequent contributions may be made from this point onwards.

However, you can buy into it in the same year with a view to withdrawing it later.

Can you make subsequent contributions after the normal pensionable age too?

Yes. If you are working beyond ordinary retirement age, earn an AHV/AVS income and have not yet drawn an account, you can continue to make retrospective payments into pillar 3a. After age 70, you cannot make any more ordinary or retroactive contributions to pillar 3a.

Can you top up gaps in your pillar 3a if you are self-employed?

Yes. Self-employed people can buy into pillar 3a too. However, as with employees, this is limited to the small pillar 3a maximum amount (CHF 7,258 as of 2026), even if self-employed people are allowed to pay higher regular contributions.

Are there lock-in periods for subsequent pillar 3a purchases like there are with a pension fund?

No. Unlike pension funds, there is no lock-in period for withdrawals where contributions to pillar 3a are concerned. Assets may be withdrawn at any time without restrictions in accordance with the statutory criteria.

Can subsequent contributions also be freely invested?

Yes. If you build up pillar 3a assets at a later date, this money will be invested in the chosen investment strategy too. At relevate, you change your strategy at any time – it’s easy and straightforward via the dashboard.

Can I contact relevate directly if I have any more questions about subsequent contributions?

Yes. relevate offers its clients the opportunity to contact them in person at welcome@relevate.ch to find out more about the topic of retrospective pillar 3a contributions.

Please do not hesitate to contact us if you have any questions or if anything is unclear. We would be happy to help you to get the most out of your pillar 3a subsequently.